A construction surety bond is an important aspect in the construction industry, supplying a financial guarantee that makes sure the completion of a project and the fulfillment of contractual obligations. These bonds serve as a safety net for project owners, subcontractors, and suppliers by safeguarding them from financial losses resulting from contractor defaults, delays, or other issues. Understanding the complexities of construction surety bonds is important for contractors and stakeholders associated with construction projects.

A construction surety bond generally includes three celebrations: the principal (the contractor), the obligee (the project owner), and the surety (the bonding company). The principal is responsible for getting the bond, which acts as a guarantee to the obligee that the principal will perform their contractual tasks. The surety, typically an insurer or a specialized surety firm, finances the bond and assures to cover any losses incurred by the obligee if the principal fails to fulfill their obligations. This tri-party agreement is fundamental to the efficiency of construction surety bonds.

One of the main types of construction surety bonds is the bid bond. A bid bond guarantees the project owner that the contractor's bid is sent in good faith and that the contractor intends to participate in the contract at the bid price if chosen. If the contractor fails to honor their bid, the surety compensates the project owner for the distinction between the defaulting contractor's bid and the next most affordable bid. This bond secures project owners from the risk of contractors submitting lowball quotes just to withdraw or fail to honor them, which can lead to project delays and increased costs.

Performance bonds are another important kind of construction surety bond. These bonds guarantee that the contractor will complete the project according to the terms and conditions of the contract. If the contractor defaults, the surety steps in to either complete the project or compensate the project owner for the financial loss as much as the bond quantity. Performance bonds supply peace of mind to project owners, ensuring that they will get an ended up project even if the contractor encounters financial or operational problems.

Payment bonds are carefully related to performance bonds however focus on ensuring that the contractor pays their subcontractors, suppliers, and laborers. A payment bond assurances that everybody associated with the project will be paid for their work and materials. This is especially crucial because it assists prevent liens from being placed on the residential or commercial property due to non-payment issues. For subcontractors and suppliers, a payment bond provides assurance that they will be compensated, decreasing the financial risk connected with working on large construction projects.

Maintenance bonds, also referred to as guarantee bonds, are another type of construction surety bond. These bonds guarantee that the contractor will correct any defects or issues that occur during a specified warranty period after the project's completion. If the contractor fails to address these issues, the surety will cover the costs of repairs or corrections. Maintenance bonds safeguard project owners from needing to bear the expense of fixing construction defects that ought to have been dealt with by the contractor.

The process of obtaining a construction surety bond starts with an application to a surety company. The surety performs an extensive examination of the contractor's financial stability, work history, and ability to complete the project. This assessment frequently includes a review of the contractor's credit rating, financial declarations, and references. The surety needs to be confident in the contractor's ability to satisfy their obligations because they are basically extending a line of credit. If the contractor defaults, the surety is accountable for covering the costs.

Premiums for construction surety bonds vary based on the kind of bond, the project's size and complexity, and the contractor's financial strength. Usually, the expense of a bond varies from one to three percent of the contract worth. Contractors with a strong performance history and strong financial health might protect bonds at lower rates, while those with greater viewed threats might deal with greater premiums or extra requirements such as security or co-signers.

The advantages of construction surety bonds extend beyond financial defense. They also promote accountability and professionalism within the construction industry. By needing bonds, project owners can evaluate contractors for their financial and functional stability, minimizing the risk of project failures. This, in turn, promotes a more competitive environment where contractors aim to preserve high requirements to get approved for bonding.

Furthermore, construction surety bonds help develop trust among all parties involved in a project. Project owners gain self-confidence that their financial investments are secured, subcontractors and suppliers feel safe and secure about getting payments, and contractors show their commitment to fulfilling contractual obligations. This trust can lead to stronger business relationships and more chances for future projects.

In recent years, the construction industry has actually dealt with different difficulties, including economic construction performance surety bond services variations, labor scarcities, and regulative changes. In this context, construction surety bonds have become even more essential. They supply a layer of stability and security, assisting to reduce risks and ensure the effective completion of projects regardless of unpredictabilities.

In conclusion, construction surety bonds play an essential role in the construction industry by providing financial warranties that safeguard project owners, subcontractors, and suppliers. These bonds include bid bonds, performance bonds, payment bonds, and maintenance bonds, each serving a specific function to ensure that contractual obligations are satisfied and financial losses are reduced. By promoting accountability, trust, and professionalism, construction surety bonds contribute to the total stability and success of construction projects, benefiting all stakeholders involved.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Atticus Shaffer Then & Now!

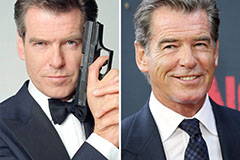

Atticus Shaffer Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!